CTP N.V. Q1 2022 Trading Update

Thursday, 19.05.2022.

Thursday, 19.05.2022.

15:54

15:54

AMSTERDAM, 18 May 2022 - CTP N.V. (CTPNV.AS), (ŌĆśCTPŌĆÖ or the ŌĆśCompanyŌĆÖ) Continental EuropeŌĆÖs largest owner, developer and manager of high quality industrial and logistics real estate by gross lettable area (GLA), reported strong like-for like rental growth of 4.8%1 in the first quarter, across its investment portfolio in European markets. Net rental income rose 37% to Ōé¼107.2 million in the first three months of 2022, compared with Ōé¼78.1 million in the same period of last year. For projects under construction at the period end, CTPŌĆÖs market leading yield-on-cost was a solid 10.2%. The GroupŌĆÖs owned investment property portfolio grew to 9.3 million sqm of GLA following the integration of Deutsche Industrie REIT-AG into CTPŌĆÖs consolidated financial and operational metrics in February 2022.

Remon Vos, CEO said: ŌĆ£We entered 2022 focused on capitalising on the significant expansion momentum the Group achieved last year but are now closely monitoring for any impact arising from the accelerating macroeconomic headwinds and the war in Ukraine. To-date, CTP has not experienced any material effects following Russia`s invasion on 24 February, however, the conflict has compounded construction supply chain disruptions that arose during the pandemic and ignited inflation to the highest levels in decades. We have been largely able to mitigate rising costs thanks to our in-house construction team, centralised procurement capabilities and ability to offset inflationary pressures through increased rents both on new developments and within our standing portfolio.

Looking forward, we remain confident the European industrial and logistics sector will continue to benefit from positive tailwinds as occupiers seek to enhance the resilience of their regional and national supply chains, through nearshoring operations as well as maintaining higher levels of stocks close to their main markets, which will underpin demand for space. This durable demand for high quality assets from a diverse range of occupiers, combined with historically low vacancy rates in supply constrained markets, is now translating into meaningful rental growth across the CTP portfolio. Equally, we believe the European industrial and logistics sector continues to offer significant development potential, with structurally higher rates of long-term economic growth projected for our core CEE markets in particular."

Key Highlights

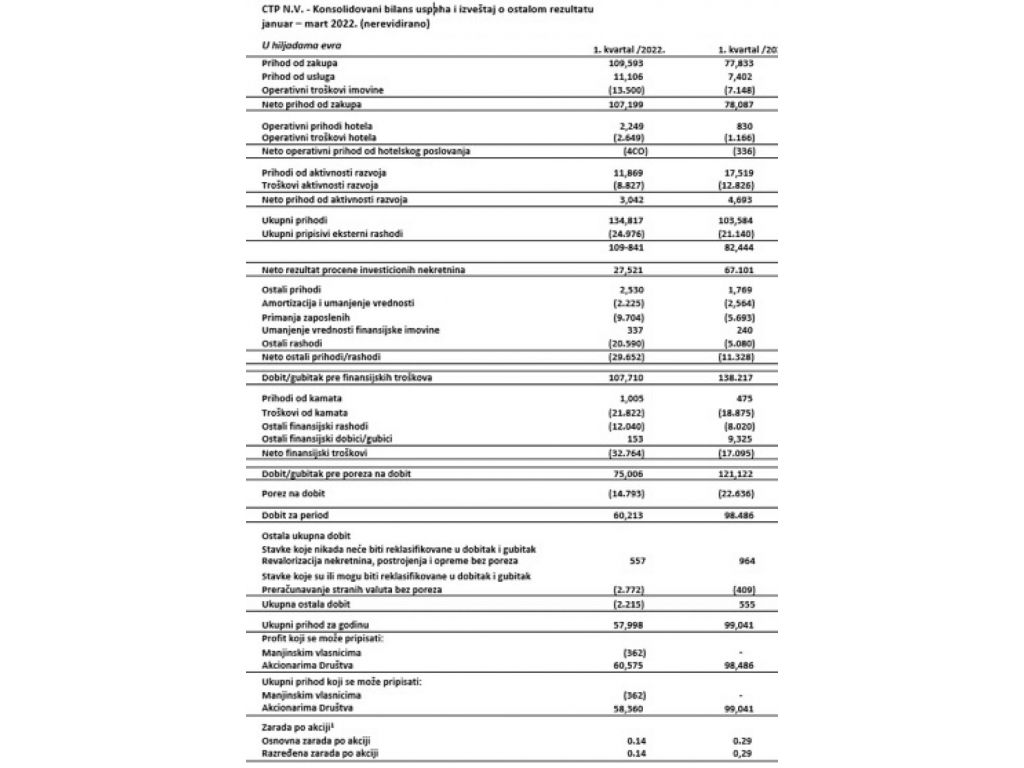

3 months to 31 March 2022 ('000) | 3 months to 31 March 2021 ('000) | % Increase | |

Net rental income | €107,199 | €78,087 | 37% |

Net valuation result on investment property2 | €27,521 | €67,101 | -59% |

Profit for the period | €60,213 | €98,486 | -39% |

Company specific adjusted EPRA earnings | €59,258 | €40,232 | 48% |

Investment property | €8,602,990 | €5,514,164 | 56% |

Investment property under development | €915,724 | €470,832 | 94% |

EPRA net tangible assets per share (in Euro) | €12,33 | 9,35 € | 32% |

Yield-on-Cost of developments | 10,2% | 11,5% | |

LTV | 44,1% | 38,1% |

Disciplined and profitable growth of CTPŌĆÖs pan-European portfolio

CTP`s highly profitable development programme continued in line with expectations in Q1 and remains well positioned to capitalise on the strong occupational demand and low vacancy rates within the Group`s core markets. Progress in the first quarter of 2022 includes:

ŌĆó New construction projects totaling 233,000 sqm commenced (31 Mar 2021: 374,000 sqm), taking the total projects under construction as at 31 March 2022 to 1,144,000 sqm, of which 44% are pre-let securing Ōé¼29 million of contracted rent.

ŌĆó Completion of 47,000 sqm of high-quality developments (31 Mar 2021: 34,000 sqm) of which 68% are pre-let, securing c.Ōé¼4 million of contracted rent.

ŌĆó For the total projects under construction at the period end, yield-on-cost remained strong at 10.2% despite increased construction costs, exceeding the Group`s target of over 10% (31 Mar 2021: 11.5%).

ŌĆó Some 2.8 million sqm of landbank secured, almost all via options, increasing the Group`s total landbank to an industry-leading 20.3 million sqm (31 Dec 2021: 17.8 million sqm), offering the development potential to almost double our current portfolio.

Proactively protecting and enhancing both income and capital value

Through its long-standing client relationships and proactive approach to managing its investment portfolio, the Group continues to maintain strong operational performance and portfolio metrics including:

ŌĆó Low vacancy rates of 6% (31 Dec 2021: 6%) and high client retention rates of 95% (31 Dec 2021: 92%).

ŌĆó An attractive portfolio WAULT of 6.3 years (31 December 2021: 6.0 years).

ŌĆó Sustained rent collection levels with 98% of payments being received before falling due (31 Dec 2021: 98%).

ŌĆó Capturing the reversionary potential inherent in the investment portfolio with 4.8%1 like-for-like rental growth recorded in Group`s investment portfolio, across both new lettings and lease regears.

Placing ESG at the core of what we do

In line with its ESG aspirations, CTP continues to seek to deliver meaningful value for all stakeholders. Strategic priorities for 2022 include the build-out of its solar capacity, bolstering its ŌĆścarbon-negativeŌĆÖ operations and improving its transparency and disclosure by enhancing sustainability performance reporting and obtaining key ESG ratings. Key ESG initiatives commencing in Q1 2022 include:

ŌĆó The construction of solar power plants across the entire Hungarian portfolio, with the first phase of four buildings at CTPark Budapest West (Biatorb├Īgy), Dunaharaszti and CTPark Budapest East (├£ll┼æ). Each of these plants which become operational in 2022, cover an area of 9,000 sqm and can generate c.500 kWp power. Further plants will be developed with capacity totaling up to 3,000 kWp this year.

ŌĆó Ongoing S&P CSA and ESG evaluation and GRESB assessment, as well as preparing for the external quality assurance as required by the commencement of the EUŌĆÖs Corporate Sustainability Reporting Directive (CSRD).

ŌĆó Ongoing commitment to provide financial and operational support to help the humanitarian effort following the Russian invasion of Ukraine in February. To date, the Group has made a financial donation to the UN Refugee Agency (UNHCR), as well as provided vacant warehouse space to local relief agencies for humanitarian supplies at its parks in Hungary, Romania, Slovakia and the Czech Republic.

Robust balance sheet and strong liquidity position

In line with its proactive and prudent approach the Group benefits from a solid liquidity position to fund its growth ambitions, with a fixed cost of debt and conservative repayment profile. On 20 January 2022, CTP closed a Ōé¼700 million four-year green bond under its eight billion EMTN programme, and simultaneously successfully tendered Ōé¼168 million in bonds of its 2025 Series. The pricing of the annual coupon in JanuaryŌĆÖs four-year tranche was fixed at 0.875%. As at the 31 March 2022 the GroupŌĆÖs:

ŌĆó Net Loan-to-Value is 44.1% (31 Dec 2021: 42.8%).

ŌĆó Average debt maturity stands at 6.0 years (31 Dec 2021: 6.2 years), with an Average Cost of Debt of 1.2%, down from 1.19% at the 31 December 2021, of which 99.5% of fixed/hedged.

ŌĆó Interest Coverage Ratio (ICR) of 4.4 times.

ŌĆó Cash position of Ōé¼1.14 billion (31 Dec 2021: Ōé¼892.8 million)

Integrating Deutsche Industrie REIT-AG into CTP Germany

On 3 February 2022, CTP NV announced the completion of the takeover and delisting offer for Deutsche Industrie REIT-AG (now named Deutsche Industrie Grundbesitz AG, ŌĆśDIG`). This acquisition, which includes 90 assets (representing 1.7 million sqm of GLA), provides the Group with immediate scale in EuropeŌĆÖs largest economy. DIG is being integrated into CTP Germany and CTPŌĆÖs wider pan-European operating platform and brings a unique platform for both for new and brownfield development as well as a significant opportunity to drive value through proactive asset management. Notable operational progress made during two months since the takeover include:

ŌĆó The appointment of two Regional Development Directors who start on 1 June and 1 July 2022, along with CTP GermanyŌĆÖs Regional Construction Director, ensuring the Group is on track to have recruited a team of 25 by end FY 2022, and a team of 50 by end FY 2023. The Berlin, Dusseldorf and the southern German office are on schedule to be opened during H2 2022.

ŌĆó The immediate implementation of CTP GermanyŌĆÖs four pillar portfolio strategy of ŌĆśhold and maintainŌĆÖ; ŌĆśhold and investŌĆÖ; ŌĆśhold and convertŌĆÖ and ŌĆśsellŌĆÖ. In particular, the proactive management of the portfolio to unlock significant value through improving occupancy levels and capturing rental growth is gaining momentum with a total of 22,000 sqm of net lettings secured reducing vacancy by over 1%.

ŌĆó Like-for-like rental growth across the German portfolio of 2.8% was recorded for Q1 2022.

ŌĆó Capitalising on the significant tenant-led development and redevelopment opportunity that exists in and around the existing portfolio footprint, focusing predominately on last mile and urban logistics assets. Sites for new projects with GLA of c.200,000 sqm, with the potential to deliver Ōé¼14 million of contracted rent, have been identified, with the start of construction anticipated within the next the 18 months.

1 The like-for-like gross rental growth compares the growth of the gross rental income of the portfolio that has been consistently in operation (not under development) during the two preceding 12-month periods that are described. Excludes CTP Germany, Netherlands, and Bulgaria due to absence of like-for-like rental growth comparables. Previously the Group reported the like-for-like rental growth comparing the rent level between two periods calculated based on the same portfolio of contracts (not taking any new leases amendments or extensions into consideration).

2 No revaluation took place on CTPŌĆÖs income-producing portfolio during Q1 2022 and Q1 2021. Revaluation of the Income Producing Properties under development, negatively impacted by increase of construction costs in Q1.

WEBCAST AND CONFERENCE CALL FOR ANALYSTS AND INVESTORS

At 08.00am (BST) and 09.00am (CET) on the day, the Company will host a video presentation and Q&A session for analysts and investors, via a live webcast and audio conference call.

To view the live webcast, please register ahead at:

https://www.investis-live.com/ctp/627a53e91e73890c00474922/cttq

To join the presentation by conference call by telephone, please dial one of the following numbers and enter the participant access code 729800.

UK 0800 640 6441

United Kingdom (Local) 020 3936 2999

All other locations +44 (0) 203 936 2999

Press *1 to ask a question, *2 to withdraw your question, or *0 for operator assistance.

The recording will also be available on-demand until Wednesday 25 May 2022. To access the telephone replay dial one of the numbers below and enter the participant access code 407165.

UK: 020 3936 3001

All other locations: +44 20 3936 3001

CONTACT DETAILS FOR ANALYST AND INVESTOR ENQUIRIES:

CTP

Jan-Evert Post, Head of Funding & Investor Relations

Mobile : +420 607 202 018

Email : jan.evert.post@ctp.eu

CONTACT DETAILS FOR MEDIA ENQUIRIES:

Bellier Communication

Steve Hays

Mobile : +31 6 52 31 07 62

Email : steve.hays@bellierfinancial.com

CTP FINANCIAL CALENDAR

Action | Date |

Publication 2022 First Quarter Results | 18 May 2022 |

Publication 2022 Half-Year Results | 10 August 2022 |

Publication 2022 Third Quarter Results | 9 November 2022 |

About CTP

CTP is Continental EuropeŌĆÖs largest owner, developer and manager of logistics and industrial real estate by gross lettable area, owning over 9.3 million sqm of space in ten countries per 31 March 2022. CTP is the only developer in the region with its entire portfolio BREEAM certified and became carbon neutral in operations in 2021, underlying its commitment to being a sustainable business. For more information visit our corporate website: www.ctp.eu

Forward looking disclaimer

This announcement contains certain forward-looking statements with respect to the financial condition, results of operations and business of CTP. These forward-looking statements may be identified by the use of forward-looking terminology, including the terms "believes", "estimates", "plans", "projects", "anticipates", "expects", "intends", "targets", "may", "aims", "likely", "would", "could", "can have", "will" or "should" or, in each case, their negative or other variations or comparable terminology. Forward-looking statements may and often do differ materially from actual results. As a result, undue influence should not be placed on any forward-looking statement. This press release contains inside information as defined in article 7(1) of Regulation (EU) 596/2014 of 16 April 2014 (the Market Abuse Regulation).

CTP invest d.o.o.

CTP invest d.o.o.

Izdanje Srbija

Izdanje Srbija Serbische Ausgabe

Serbische Ausgabe Izdanje BiH

Izdanje BiH Izdanje Crna Gora

Izdanje Crna Gora

News

News